Description

Integration with existing systems is driving the market growth

A key factor driving the market for communication-based train control (CBTC) is integration with existing systems. Ability to effortlessly integrate CBTC technology with existing infrastructure becomes a key factor as railway operators look to update their networks and increase operational efficiency. In addition to reducing disruptions during the installation phase, this integration also uncovers a plethora of advantages that support the market’s general expansion and success.

Railways frequently have substantial investments in antiquated control and signaling systems. These systems can be too expensive and time-consuming to completely revamp. Because CBTC systems are flexible enough to cohabit and interface with older technologies, a phased migration strategy is possible. As a result, rail operators can update their systems gradually without having to make a big upfront investment, resulting in a smoother transition.

The functional elements of the current infrastructure that still have value are preserved through the integration of CBTC with legacy systems. It enables railways to make the most of their prior expenditures in things like track design, stations, and other crucial elements. They may then concentrate their efforts on improving only those elements that are essential, which results in a more effective use of resources. Additionally, this strategy increases the lifespan of current assets, postponing the requirement for total replacement and significantly reducing expenses.

Interoperability is promoted by the CBTC’s capacity to be integrated with many existing systems. Railways frequently run a variety of trains, each with a unique set of technical requirements. These various types of rolling stock may be communicated with using CBTC technology, ensuring a uniform level of control and safety throughout the network. This flexibility is especially useful in cities where a variety of commuter, regional, and high-speed trains may coexist.

Integration takes operational continuity into account. Railways are a vital piece of infrastructure that serve both passengers and freight 24 hours a day. Inconvenience for passengers and large revenue losses might result from service interruptions during system enhancements. The gradual integration strategy used by CBTC reduces downtime and service interruptions, resulting in a smoother transition that gives operational requirements priority.

By increasing demand for specialist knowledge, the integration process itself stimulates market expansion. Experienced engineers, technicians, and consultants in CBTC integration become priceless resources that promote job growth and industrial advancement. As more railways come to understand the benefits of CBTC integration, there is an increasing need for qualified personnel in this specialized industry. Thus, driving the Communication based train control market revenue.

Communication Based Train Control Market Segment Insights:

Communication based train control Train Type Insights

The Communication Based Train Control Market segmentation, based on Train Type, includes Metro, Monorail, Commuter Rail and Freight Rail System. The metro segment dominated the market in 2022. Public transportation options that are effective, dependable, and ecological are in higher demand as cities expand. Metro systems offer a high-capacity form of transit that can lessen traffic congestion and the negative environmental effects of urban mobility.

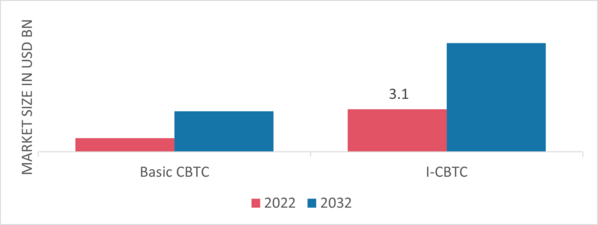

Communication based train control Type Insights

The Communication Based Train Control Market segmentation, based on type, includes Basic CBTC and I-CBTC. The I-CBTC segment dominated the market in 2022. I-CBTC systems offer cutting-edge analytics and real-time data insights, enabling operators to more efficiently monitor and improve train operations. Operators can improve efficiency, minimize delays, and improve overall system performance by assessing train performance, passenger flow, and network congestion.

Figure 1: Communication Based Train Control Market, by type, 2022 & 2032 (USD Billion)

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Communication based train control Automation Grade Insights

The Communication Based Train Control Market segmentation, based on Automation Grade, includes GoA1, GoA2, GoA3 and GoA4. The GoA4 category generated the most income in 2022. GoA4, which stands for completely automated operation without any onboard personnel, is a key area of concentration for the development of the CBTC business. GoA4 systems may become more prevalent as technology develops and rail operators work to enhance efficiency, capacity, and safety. These solutions provide reduced headways, ideal train spacing, and real-time adaptability to changing circumstances.

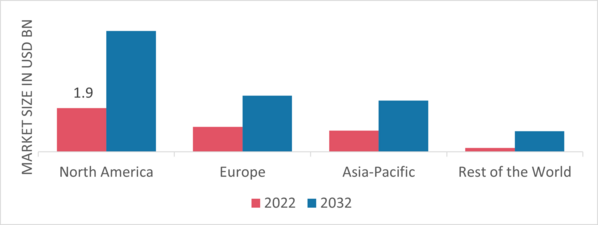

Communication based train control Regional Insights

By region, the study provides the market insights into North America, Europe, Asia-Pacific and Rest of the World. The North America Communication Based Train Control Market dominated this market in 2022 (45.80%). In order to handle population growth and enhance transit alternatives, several North American towns are investing in the enlargement and upgrading of existing rail networks. CBTC technologies make it possible to expand the network effectively by increasing capacity and improving train spacing. Further, the U.S. Communication based train control market held the largest market share, and the Canada Communication based train control market was the fastest growing market in the North America region.

Further, the major countries studied in the market report are The U.S., Canada, German, France, the UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil.

Figure 2: Communication Based Train Control Market Share By Region 2022 (USD Billion)

Source: Secondary Research, Primary Research, MRFR Database and Analyst Review

Europe Communication based train control market accounts for the second-largest market share. The enormous high-speed rail networks in Europe are well known. CBTC technology offers precise train control and collision avoidance capabilities, which can improve the safety and effectiveness of high-speed rail operations. Further, the German Communication based train control market held the largest market share, and the UK Communication based train control market was the fastest growing market in the European region.

The Asia-Pacific Communication Based Train Control Market is expected to grow at the fastest CAGR from 2023 to 2032. Rapid urbanization is taking place in several APAC nations, which is increasing city population concentrations. This increases the need for dependable public transit systems, particularly networks for the metro and subway that can be improved utilizing CBTC technology. Moreover, China’s Communication based train control market held the largest market share, and the Indian Communication based train control market was the fastest growing market in the Asia-Pacific region.

Communication Based Train Control Key Market Players & Competitive Insights

Leading market players are investing heavily in research and development in order to expand their product lines, which will help the Communication based train control market, grow even more. Market participants are also undertaking a variety of strategic activities to expand their global footprint, with important market developments including new product launches, contractual agreements, mergers and acquisitions, higher investments, and collaboration with other organizations. To expand and survive in a more competitive and rising market climate, Communication based train control industry must offer cost-effective items.

Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the global Communication based train control industry to benefit clients and increase the market sector. In recent years, the Communication based train control industry has offered some of the most significant advantages to medicine. Major players in the CBTC System market, including Alstom (France), Thales Group (France), Wabtec Corporation (U.S.), Mitsubishi Electric (Japan), Hitachi (Japan), Siemens Mobility, Inc (Germany), ABB (Sweden), Argenia Railway Technologies Inc.(Canada), Toshiba (Japan), WAGO Corporation (U.S.) and others, are attempting to increase market demand by investing in research and development operations.

Siemens AG (Siemens) focuses on technology. The automation, digitalization, and electrification fields are all covered by its operations. The company designs, develops, and manufactures goods in addition to installing complex projects and systems. Additionally, it provides a range of uniquely created solutions for various demands. Power generation and delivery, intelligent building infrastructure, and distributed energy systems are Siemens’ areas of expertise. It provides medical technology, smart mobility solutions, and digital healthcare services for the road and rail transportation sectors. Siemens maintains locations for its manufacturing plants, distribution centers, and sales offices all around the world. It offers clients services in a variety of industries, such as manufacturing, infrastructure, process, and energy. Siemens has its headquarters in Munich, Bavaria, Germany.

Thales SA (Thales), which also provides smart technologies, electronic systems, software, ground transportation, services, and equipment, serves the aerospace, defense, and security markets. It provides training solutions, flight avionics, electrical systems, electric systems, and air traffic management systems for the aircraft sector. The company also provides radio communications products, network and infrastructure systems, vital information systems, weapon systems, protection systems, and cybersecurity solutions for the ground, marine, and air defense industries. Thales additionally offers maintenance, repair, and training services. The company operates in the Americas, Europe, the Middle East, Africa, and Asia-Pacific. Paris, Ile-de-France, France, is home to Thales’ main office.

Communication Based Train Control Industry Developments

July 2023: Toshiba Electronic Devices & Storage Corporation launched the TRSxxx65H series, a third generation of silicon carbide Schottky barrier diodes for industrial equipment.

July 2023: Siemens Mobility, Inc and ubitricity partnered with Redbridge Council to boost the borough’s electric vehicle (EV) network with over 300 new on-street charge points.

June 2023: Mitsubishi Electric announced its plans to invest an additional 42.5 billion yen to construct a second production building for the manufacture of factory automation (FA) control-system products at Owariasahi City, Aichi Prefecture part of its Nagoya Works campus.

Report Scope

| Report Attribute/Metric | Details |

| Market Size 2022 | USD 4.1 Billion |

| Market Size 2023 | USD 4.57 Billion |

| Market Size 2032 | USD 10.9 Billion |

| Compound Annual Growth Rate (CAGR) | 11.50% (2023-2032) |

| Base Year | 2022 |

| Market Forecast Period | 2023-2032 |

| Historical Data | 2018- 2022 |

| Market Forecast Units | Value (USD Billion) |

| Report Coverage | Revenue Forecast, Market Competitive Landscape, Growth Factors, and Trends |

| Segments Covered | Train Type, Type, Automation Grade, and Region |

| Geographies Covered | North America, Europe, Asia Pacific, and the Rest of the World |

| Countries Covered | The U.S., Canada, German, France, UK, Italy, Spain, China, Japan, India, Australia, South Korea, and Brazil |

| Key Companies Profiled | Alstom (France), Thales Group (France), Wabtec Corporation (U.S.), Mitsubishi Electric (Japan), Hitachi (Japan), Siemens Mobility, Inc (Germany), ABB (Sweden), Argenia Railway Technologies Inc.(Canada), Toshiba (Japan), WAGO Corporation (U.S.) |

| Key Market Opportunities | Strict emission standards. |

| Key Market Dynamics | Rising demand in emerging regions for train control and management systems. |