Description

INTRODUCTION – Global Rail Signalling Market 2022-2027

The rail traffic is kept in control through a uniform system – Railway signaling. The process helps to maintain railway traffic, keeping paths clear for other trains. There are various technologies which are being put in use such as Automatic Train Protection system, European Train Control System, Communication Based Train Control System, Positive Train Control System, and Automatic Train Operation System.

This market because of its key role in Railways provides various companies to compete to come up with the best solutions for railway signaling and thus, the market is always opportunistic and demands advancements and efficient designs in the operation of the same.

In rail signaling market report, we will further dwell on the topic to understand the various characteristics associated with this marketplace.

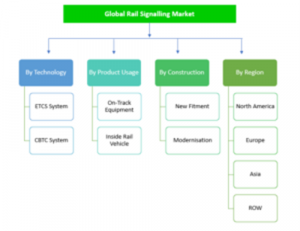

RAIL SIGNALLING MARKET SEGMENTATION

GLOBAL RAIL SIGNALING MARKET DYNAMICS

| SI No | Timeline | Company | Updates |

| 1 | October 2021 | Hitachi Rail | Network Rail awarded the contract to Hitachi Rail and Linbrooke in order to improve the digital signal solution to improve reliability and safety in the Gloucester area. |

| 2 | July 2021 | Vossloh | Vossloh Rail services opened a new service company in Italy with the introduction of milling solutions giving way to rail maintenance. |

| 3 | December 2021 | Stadler | Stadler’s main goal was to become a strong provider of modern signaling equipment and in order to achieve this, they acquired the Swiss company BAR Bahnsicherung AG. |

| 4 | March 2021 | Hitachi Rail | Hitachi Rail partnered with Trafikverket in order to roll out its ERTMS level 2 signaling system on the Malmbanan article section and for railway digitalization. |

| 5 | January 2021 | Hitachi Rail | Hitachi Rail and Thales Group Transportation partnered in order to strengthen GTS signaling activities. |

Some of the important drivers of rail signaling market market can be listed below:

- Growth in demand and usage of high-speed railway locomotives.

- Increased investment in Railway projects from government and private entities.

- Increased globalization, demanding for more transportation of products.

- Increased number of people traveling through railways.

On the other, some of the other factors which are responsible for hindering the growth of this market are High installment cost and the increased importance of smart solutions.

The rail signaling market can be segmented into various domains, I.e., Type, Technology, and Application. Based on type the market is divided into CBTC, PTC, and ATC. Based on technology, the market division is ATP, ATO, CBTC, ETCS, and PTO System. By application, the market is divided into two parts: Inside the station and Outside the station.

There have been considerable investments in railway network expansion projects in various developing regions around the globe. Additionally, the developed countries are further focusing on installing efficient technologies in replacement to existing signal controlling systems.

Also, the developing countries are investing in the same to give a boost to their economy. To add, the major cities are also investing in expanding. Somewhere in 2018, Ramball announced that they acquired DEG signal to expand their influence in the rail industry. Thus, grabbing opportunities to serve clients on a global scale.

The rail signaling market is mainly dominated by recognized players and regional giants exist in their respective areas. GE Transportation and Bombardier Inc have a strong presence in the North American Market. The major rail signaling market market players in the European region are ALSTOM, Siemens, and Thales. The domestic Chinese manufacturers are focusing on developing internationally quality products and are there acting as major competitors to other major rail signaling market players.

GLOBAL RAIL SIGNALING MARKET SIZE AND FORECAST

Geographically, the major regions with major subregions of rail signaling market can be listed:

North America: US, Mexico, Canada. Europe: Germany, Italy, UK, Spain, France, Switzerland, Belgium, Turkey, and the Rest of Europe. Asia-Pacific: Japan, China, India, South Korea, Australia, Singapore, Thailand, Malaysia, Indonesia, and the Rest of the region. The Middle East and Africa comprising of UAE, Israel, South Africa, and Saudi Arabia.

The North American and European regions are well-established markets for signaling systems. The market for railway signal systems is expected to observe steady growth in these regions in the forecast period. China is expected to be the flourishing ground for this market in the forecast period as it has planned to expand its railway network for high-speed rail transport.

The CBTC system is a modern railway signaling system used primarily in the urban railway network. The increasing number of metro railway networks in Asia and the Middle East provides a positive outlook for suppliers. Countries covered in the Asia Pacific region primarily focus on the CBTC system.

The gradual replacement of old and traditional signaling systems with inexpensive and reliable solutions expected to further drive the market in a positive direction. Globally, countries also spend a significant amount on ETCS to improve the safety and efficiency of railway transportation.

NEW DEVELOPMENTS IN THE RAIL SIGNALING MARKET

| SI No | Timeline | Company | Developments |

| 1 | August 2021 | Siemens Mobility | RTS Operations awarded a contract to Siemens Mobility in order to establish not only CBTC signaling systems and also a Platform Screen Door System on the Malaysia and Singapore border link. |

| 2 | June 2021 | Alstom | Alstom delivered 50 of their DE 18 freight locomotives with its latest on-board signaling solution. |

| 3 | May 2021 | Siemens | Siemens Mobility and Stadler won a €114.5 million contract in order to provide the art signaling system and a new fleet of modern trains for the Lisbon Metro. |

| 4 | January 2021 | Alstom | Alstom will equip a total of 13 freight locomotives for DB Cargo with its latest ETCS signaling standard for European freight. |

| 5 | January 2021 | Alstom | Alstom won a new contract of €106 million from National Capital Region Transport Corporation Ltd(NCRTC) in order to design, install and supply the signaling, train control and telecommunication system. |

India’s first semi-high-speed train is the Vande Bharat Express. The Vande Bharat Express’ journey is about more than just building India’s first world-class, semi-high-speed intercity train, which was wholly conceived, constructed, and manufactured in the country.

It also marks the start of a process to modernise the rail signaling system by switching to locally designed, digital Automatic Train Protection (ATP) and Train Collision Avoidance systems (TCAS).

ATP and TCAS, like the Vanda Bharat Express, are designed and manufactured in India, in this case by Indian research groups and vendors, and work in the same way as the European Train Control System (ETCS). The Indian design is less expensive for Indian Railways, despite the fact that they perform identically.

The Vande Bharat Express is the initial stage in updating India’s ageing railway signaling infrastructure. TCAS is fully integrated into the railway signaling system and relies on communication between trains and a regional, central control system.

Trackside equipment, sensors, IoT devices, and locomotive-based control equipment are all part of TCAS. All line-side information, such as ‘track work ahead’ or’stopped train ahead,’ is supplied electronically to the locomotive, removing the need for the driver to monitor these signals.

RAIL SIGNALING MARKET COMPETITIVE LANDSCAPE

| SI No | Timeline | Company | Updates |

| 1 | Q3-2021 | Vossloh | The sales revenue of Vossloh at the end of September was €698.4 million and in 2020 the sales revenue was €617.7 million. |

| 2 | Q3-2021 | Ircon International Ltd | At the end of the third quarter the revenue of Ircon was Rs 1,421 crores and in the previous year the revenue was Rs 967.8 crores. |

| 3 | Q3-2021 | Thales | The total sales of Thales at the end of the third quarter was €3.55 billion and in 2020 the total sales was €3.57 billion. |

| 4 | December 2021 | Stadler | Stadler completed the acquisition of BBR Verkehrstechnik which is a german signaling company. With this acquisition the company will create a new signaling division. |

| 5 | July 2021 | Vossloh | Vossloh signed an agreement in order to acquire the ETS Spoor BV and to expand its position in the Dutch market. |

Chinese suppliers are increasing their influence by grabbing projects from outside the country. There’s a huge underlying potential that exists for the systems that meet European rail traffic management system and communication-based traffic control requirements.

The Increasing standardization of rail signaling solutions is one of the most important trends in the market. The standardization of materials allows the manufacturers to develop core, standards-based global architectures that enable interoperability necessary to meet local safety requirements.

European Rail traffic management system is looking forward to the use of satellite positioning technology to be applied into their systems. This will allow train on different segments to maintain safe distances from each other. ASTRail is the one organization that is helping the European regions to come up with these efficient solutions by providing automation and increasing the efficiency of the rail transportation management techniques.

Also, various startups have come up with many insightful techniques to efficiently improve rail signaling mechanisms. The South African startup GEAR international Holdings uses rain location information for interlocking and enables CBTC. The startup’s signaling solutions ensure safety, optimize train movements and maximize the use of platform availability.

Humantics, a US-based startup offers an easy installation location system that identifies the positions of the coaches. They have created their Humantics Rail Navigation System that is powered by UWB signaling, these solutions enable automatic train operations and driver assistance by also ensuring the safety of rail construction operations. TekTracking, another US-based startup has similar Solutions to efficient rail signaling systems.

STTraffic, a South Korean startup develops particularly CBTC solutions. Their solution enables safe rail operations and optimizes train efficiency.

RAIL SIGNALING MARKET COMPANY PROFILE

The following list of companies are the major market players in the global rail signaling market:

- Unife

- TSTS

- MERMEC Incorporation

- Mipro Oy

- Vossloh

- Toshiba Infrastructure Systems & Solutions Corporation

- Alstom

- Hitachi Rail STS

- Bombardier

- Cisco Systems Inc

- Siemens

- Thales Group

- Nippon Signal Co. Ltd

- IRCON

- Kyoson Electric Mfg. Co. Ltd.

- Belden Inc

THIS RAIL SIGNALING MARKET REPORT WILL ANSWER FOLLOWING QUESTIONS

- Rail Signaling Market size and Forecast, by region, by application

- Average B-2-B price for Rail Signaling Market, by region, per user

- Technology trends and related opportunity for new Rail Signaling Market tech suppliers

- Rail Signaling Market share of leading vendors, by region,

- Coronavirus impact on Rail Signaling Market earnings