Description

INTRODUCTION – Global Rail Freight Wagon Market 2021-2026

Rail freight is an important business segment for many rail operators as its much more profitable than passenger carrier segment.Majority of the demand for freight wagons is comprised of replacement units as the overall fleet size has remained constant for many years now.

Rail freight wagons market has consistently evolved over past century and in Sep 2019, Transnet Freight Rail, inaugurated a freight train with 375 wagons and a total length of around 4 km, enabling a payload of 23,625 tonnes of manganese ore.

In Asia, China`s belt and road initiative has given a much needed to boost to rail freight in the region. The number of China-Europe freight trains has gone past 6,400 in 2019 from less than 20 in 2011. More than 65 freight train routes now originate from almost 50 Chinese cities reaching more than 40 cities in Europe.

MARKET SEGMENTATION

US FREIGHT WAGON MARKET

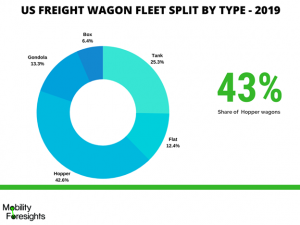

The US freight wagon market is among world`s biggest. Hoppers, tankers and flat wagons make up for more than 80% share of overall fleet. Among private freight car owners, Greenbier and TTX own approximately 0.5M wagons cumulatively. Among rail road operators, BNSF and Union pacific railroad cumulatively had 150,000 wagons.

INDIA FREIGHT WAGON MARKET

India is among world`s biggest freight wagon market, globally sourcing ~11,000 units per annum from various vendors. More than 40% of them are used in carrying coal for various thermal powerplant across the country.It released its biggest order in June 2018, when it announced a tender for 22,000 freight wagons.

Indian Railways also placed an additional order for 9,468 wagons in May 2019, costing $375 Million.The breakup of orders is as follows : 3,900 open wagons, 2,840 open rapid discharge hopper wagons, 1,000 rail wagons, 1,021 flat wagons and 700 other variety of wagons.Coal and coke contribute nearly 60 per cent of the freight traffic, followed by cement and food grains, therefore the demand for open wagons is higher than others.

Keeping in mind the delay in supply of freight wagons by private manufacturers, the Indian Railways increased its production to 4,000 wagons in 2019.

In 2006, Dedicated Freight Corridor Corporation of India Limited (DFCCIL) was set up by the Ministry of Railways to undertake planning & development, mobilization of financial resources and construction, maintenance and operation of the dedicated freight corridors.

The DFC aims to connect the Golden Quadrilateral (Delhi, Mumbai, Chennai, Kolkata) and its two diagonals (Delhi-Chennai and Mumbai-Kolkata), comprising a total of 10,122km.

INVESTMENT IN RAILROAD/ RAIL INFRASTRUCTURE FOR FREIGHT APPLICATIONS

Nov 2019– Genesee & Wyoming’s North Carolina & Virginia Railroad completed an upgrade its 90 km network to handle 130 tonne wagons

July 2019– The state owned India railways sought government approval to build three dedicated freight corridor(DFC) networks(totaling 5,770 Km in length) with an investment of $44 Billion.Construction of the first two DFC, totaling 3,360 km in length is already underway.

MARKET SIZE AND FORECAST

The global rail freight wagon market is estimated at $XX Billion in 2020 growing at –% CAGR till 2025. Due to less demand in countries like US and Russia the volume is expected to remain below 2019 level in the forecast period China. China will continue to contribute and the growth is expected to better than other countries.

RECENT ORDERS IN FREIGHT WAGON MARKET

- Dec 2019– Laude Smart Intermodal awarded a contract to United Wagon Co to supply 200 Type Sgmmns 1 435 mm gauge flat wagons for transporting heavy-duty containers

- Nov 2019-Intermodal operator TransContainer awarded United Wagon Co a contract to supply 100 Type 13-6851-05 flat wagons for the transport of heavy containers and tank containers

- Nov 2019– United Wagon co`s subsidiary (TikhvinChemMash) to supply EuroChem Group company NAK Azot with 60 Type 15-6880 methanol tank wagons by 2019 end. The 25 tonne axle load wagons have a capacity of 73 tones

- Nov 2019-National Railways of Zimbabwe signed an agreement for United Wagon Co to supply 100 open wagons

- Sep 2019– Leasing company VTG Rail Russia awarded United Wagon Co a contract to supply 150 flat wagons for carrying timber products

- Sep 2019- Russia’s State Transport Leasing Co awarded contract to United Wagon Co to deliver 5 000 grain hopper wagons by 2020-end and 20 000 open wagons by 2022-end

NEW RAIL WAGON DEVELOPMENT

- Feb 2021-Trinity Rail has developed a platform called Trinsight. The service is expected to work in tandem with the recently released RailPulsea JV that will offer advanced analytics, machine learning capabilities, and telematics to maintain fleet

- Dec 2019– TransANT Austria is testing modular wagons with exchangeable bodies which rail Cargo Group has developed in agreement with its customers. The wagons are available in lengths between 10m and 21m.

- Sep 2019-RM Rail started mass production of Type 13-1284 high-capacity container flat wagons, the wagons have a 23·5 tonne axle load and capacity of 69·8 tonnes, with the automatically welded structure offering a design life of 32 years

- Sep 2019– Greenbrier Companies announced a patent-pending Tsunami Gate door system that allows shippers to customize grain discharge speeds of covered hopper wagon was under development . The 147 m3 capacity wagon can be emptied in 30 sec, with automated unloading for staff safety

- June 2019– A new wagon developed by United Wagon Co will have a capacity of 73 tonnes, up to 2 tonnes more than older designs, with 25 tonne axle load bogies. It is also expanding its range with the development of two side tipping wagons for the transport and automated discharge of aggregates and ore

COMPETITIVE LANDSCAPE

Most of the companies in freight wagon market are expanding their presence into more geographies and developing better products with improved payload. For example- Estonian freight operator Operail has established Operail Finland with the aim of entering Finland’s rail market. It plans to invest $55M to develop the business and acquire rolling stock as part of its strategy of diversifying its activities with new services, products and markets.RM Rail’s Ruzkhimmash plant has developed a further four types of hopper wagon taking its wagon range to 78 designs.

China state owned CRRC, which is the biggest supplier of global rolling stock market with more than 30% market share has now won many orders to supply locomotives has now won orders to supply locomotives to operators in several East European countries, including Belarus, Estonia, Georgia, North Macedonia, Serbia, and Czech Republic.